Explore Your Alternatives for Hassle-Free Checking Account Opening Near You

In today's economic landscape, the process of opening up a bank account can usually appear overwhelming, yet it doesn't need to be. By checking out the different options readily available to you, including on-line bankss and local organizations, you can determine solutions tailored to your needs. Understanding the different kinds of accounts, required documents, and the steps included can significantly streamline this undertaking. There are nuances that can affect your experience dramatically; recognizing these can lead to a much more valuable banking relationship. What vital elements should you take into consideration prior to making your choice?

Understanding Savings Account Kind

Comprehending the numerous kinds of savings account is crucial for making informed financial choices. Bank accounts usually come under several groups, each developed to satisfy particular monetary requirements. The most typical kinds include cost savings accounts, inspecting accounts, and certificates of deposit (CDs)

Interest-bearing accounts are suitable for people seeking to keep funds while making interest. These accounts frequently have restricted withdrawal options but generally supply greater rates of interest compared to checking accounts. Checking accounts, on the various other hand, are made for day-to-day deals, offering easy accessibility to funds via debit cards, checks, and digital transfers. While they usually earn little to no interest, they use convenience for taking care of day-to-day expenses.

Deposit slips (CDs) are fixed-term accounts that need funds to be deposited for a specific period, often producing greater rates of interest than standard interest-bearing accounts. Very early withdrawal may sustain penalties. Various other specialized accounts consist of money market accounts, which incorporate features of cost savings and checking accounts, and private retirement accounts (IRAs), which supply tax advantages for retired life savings. Comprehending these account kinds empowers people to pick the most appropriate choices for their economic goals.

Finding In Between Online and Local Bankss

When choosing a bank, people often face the choice between online and local bankss, each offering unique benefits and downsides. On-line bankss commonly provide greater passion rates on cost savings accounts and reduced charges because of minimized expenses costs. bank account opening. Their 24/7 access permits clients to manage their financial resources easily from anywhere, making them an attractive choice for tech-savvy individuals

Protection is another vital aspect to take into consideration. While online bankss make use of advanced encryption and safety and security procedures, some people might still really feel extra comfy with the physical visibility of a neighborhood bank, where they can see team and procedures firsthand.

Ultimately, the decision in between online and local bankss relies on individual choices and financial requirements. Examining factors such as comfort, costs, rates of interest, and consumer solution will certainly assist people pick the financial option that finest fits their way of life.

Required Papers for Account Opening

Before beginning the account opening procedure, it is important to collect the essential documents to make sure a smooth experience. Different bankss may have details demands, however there are common files that you will usually need.

To start with, a valid government-issued image recognition is important. This can include a vehicle copyright, copyright, or nationwide copyright. Proof of address is commonly needed; appropriate documents might include energy bills, lease contracts, or bank statements that plainly show your name and present address.

In addition, depending upon the kind of account you wish to open up, you might need to supply your Social Safety and security number or Tax obligation Identification Number for tax obligation objectives. Both celebrations will certainly require to present their recognition and evidence of address. if you are opening a go to my site joint account.

Steps to Open Your Account

Opening a bank account entails an uncomplicated collection of actions that can streamline your financial experience. To start, directory choose the type of account that ideal suits your monetary needs, whether it's a monitoring, cost savings, or a specialized account. When you have actually made your selection, visit your picked bank's branch or browse to their web site to initiate the process.

Next, collect the needed documentation, which usually includes proof of identity, such as a government-issued ID, and proof of address, like an utility expense. bank account opening. Some bankss may also ask for your Social Safety and security number or tax obligation recognition number

After constructing your papers, complete the application, either online or in-person. Make sure that all details is total and exact to prevent hold-ups.

Once you send your application, the bank will evaluate your info, which might take from a few mins to a number of days depending on the organization. If authorized, you'll obtain details regarding your brand-new account, including your account number and any associated debit or bank card. Make an initial deposit to activate your account, and you are ready to start banking.

Tips for a Smooth Experience

To make sure a seamless bank account opening up experience, it is valuable to be well-prepared and informed about what to expect. Start by gathering all required documentation, including a valid government-issued ID, proof of address, and your Social Safety and security number. This preparation will expedite the process and stop unneeded hold-ups.

In addition, it is a good idea to arrange a consultation with a bank representative. This can assist make certain that you receive customized assistance and avoid long haul times.

As soon as at the bank, ask questions to clarify any kind of terms or features associated to your account. Recognizing the small print can protect against future hassles.

Final Thought

Finally, comprehensive research study and preparation are necessary for a smooth checking account opening experience. By comprehending numerous account kinds, considering the advantages of on-line versus neighborhood bankss, and gathering necessary documentation, individuals can navigate the process efficiently. Following detailed actions and making use of pointers can better boost the experience. Eventually, an educated technique will assist in the option of a banking organization that aligns with specific financial demands and choices.

The most typical types consist of cost savings accounts, checking accounts, and certificates of down payment (CDs)

These accounts usually have limited withdrawal alternatives however generally use higher passion prices compared to examining accounts.Certificates of down payment (CDs) are fixed-term accounts that need funds to be deposited for a given period, often generating higher passion rates than traditional cost savings accounts. Various other specialized accounts include cash market accounts, which integrate features of financial savings and checking accounts, and specific retirement accounts (Individual retirement accounts), which offer tax benefits for retirement financial savings. To begin, pick the kind of account that ideal fits your economic needs, whether it's a monitoring, savings, or a specialized account.

Heath Ledger Then & Now!

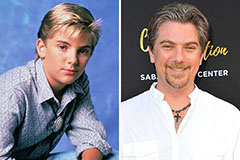

Heath Ledger Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!